Guide to involving the next generation

Engaging younger generations of a client family

Most advice businesses are small in size, and so they naturally gravitate towards older clients who, in aggregate, hold the lion’s share of investible private wealth.

This is the view of Jason Hollands, managing director, corporate affairs at Tilney Investment Management Services.

“They understand that demographic cohort well and are in touch with their needs, but are less focused on younger clients who typically have relatively small amounts of assets, as they are at an early stage in their financial journey and heavily focused on a shorter-term need of getting on the first rung of the housing ladder,” says Hollands.

“Indeed, a lot of advice firms will have a minimum client size and fee levels, which will put many younger people out of their reach and so have little focus on developing a proposition fit for younger clients.”

But Schroders’ intermediary solutions director, Gillian Hepburn, warns against adopting biases relating to younger clients.

“The two reasons advisers give me when I ask why they don’t have a wealth transfer strategy that looks to engage younger generations is that they don’t have a proposition for them or won’t make a profit,” says Hepburn.

“Many advisers also think that the next generation is only interested in technology-based solutions.”

Meanwhile, on the client side, research from Prudential indicates there is an appetite for advice among younger generations.

The provider’s survey of 1,000 advised families in November found three-quarters (73 per cent) of millennials said they had or were going to see an adviser, and 58 per cent for generation Z, partly driven by a desire to start investing.

Simon Harrington, senior policy adviser at Pimfa, says savings accumulated during lockdown could present an opportunity for advice.

“It’s important to state that while the effects of lockdown have not been equal, it is likely that for the vast majority of younger clients who are already working under advice, the global pandemic has represented something of a windfall, given dramatic drops in household consumption.

“We think that this represents an opportunity for firms to take on the new generation of clients who will want to find avenues for growth from liquid savings, which would otherwise be static in low interest bank accounts.”

A slow and steady approach

Harrington adds the nature of advice that many young savers may currently need will be transactional, rather than holistic: “They are on a savings journey, and you should help them put the building blocks in place.”

Jack Silk, a wealth management consultant at Mattioli Woods, also suggests a slow and steady approach, by initially keeping planning simple in order to engage younger clients and build trust over time.

“You’ve got to accept that these clients who are younger, if we take an example of a business client, their priority is absolutely focused around growing that business.

“And yes, they know that they need to look at financial planning, they know that they need to save for the future, get their wills and powers of attorney in place. But if you go in and bombard them straight away and say, ‘right: life cover, pensions, wills’, it gets a little bit overwhelming for them.”

It is unwise to ignore young people and wait for them to roll up in middle age, grateful to you for receiving their business

Silk adds: “I find as well that they might be a little bit disengaged, so I think it’s more of a slow and steady approach and say, 'well, let’s prioritise what these things are', and it may well be that you’ve got a really young family who’ve got no protection in place. First, let’s get your protection sorted, then let’s move onto looking at pensions or Isas or savings or whatever else.

“Once you’ve built that trust and that relationship, the rest of the planning will come. And they’ll get a little bit more familiar with how it works – the annual meetings, the advice process, and so on.”

Tilney’s Hollands also acknowledges that younger clients may not represent a "quick win" for business, but warns on overlooking the demographic.

“While younger clients may not be as immediately remunerative as mature clients, they will be in years to come as their assets and wealth grow. So it is unwise, in my view, to ignore young people and wait for them to roll up in middle age, grateful to you for receiving their business.

“Especially when there are emerging services to cater for them including robo-advisers, financial coaching services and hybrid advice models that combine digital tools with human engagement.”

Adapting the way you communicate and charge

Hollands also highlights the role of financial education when it comes to younger people.

“It is also about the tone of the language used and helping educate people who are newer to the world of financial services, through informative videos, guides and events,” he says.

“There is a really important balance here in helping build knowledge and confidence, but not talking down to younger people.”

Charges are another factor to consider, as chartered financial planner and Step England and Wales chair Denese Molyneux notes, many advice companies work under a 'funds under management' fee structure.

Once you’ve built that trust and that relationship, the rest of the planning will come

“For younger clients this may not work as they may not have acquired too much in the way of liquid wealth,” says Molyneux.

“We work on an hourly rate. We try to estimate how much work we will need to do for a client to support them on an ongoing basis and then have them pay us monthly by standing order.

“An annual review of what we’ve done and the cost with adjustments each time keeps things in order. Any unforeseen and exceptional work can be costed at the time it arises, including assimilating an inheritance.

“When you point out to a younger client that the coffee they pick up every day costs £648 per year it can focus the mind on what matters: value for money.”

Future-proofing with a family office approach

When compared to generation X and baby boomers, millennials are more likely not to have used a financial adviser, according to research from Quilter last July.

Yet the research also found that millennials were most likely to consider using an adviser if one was recommended to them by another family member.

Add to this the prediction that wealth transfers are set to exceed £100bn by 2025, according to a report from Kings Court Trust, and the figures highlight an opportunity to service the finances of a client and their family.

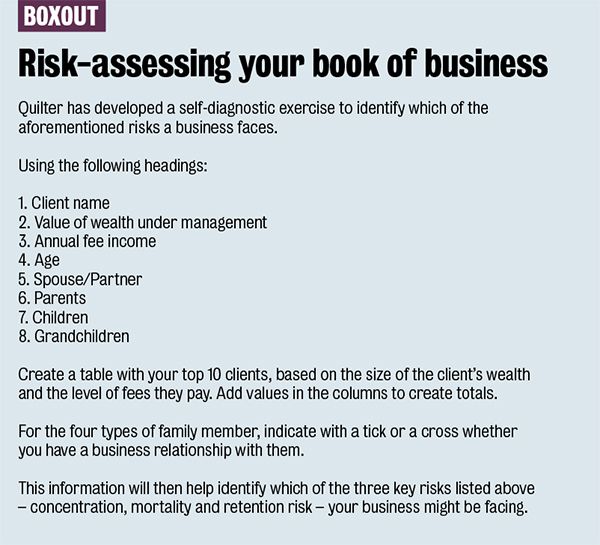

Assessing your current business

Ian Browne, retirement planning expert at Quilter, remarks that while it is common to have a good relationship with a client, which may extend to their partner, it can be rarer to also have a relationship with the client’s children.

“This presents a big risk as an adviser’s many years of hard work can be undone if they fail to engage the next generation who are ultimately in line to inherit a client’s wealth,” Browne adds.

He suggests undertaking a risk assessment of the book of business to identify any of the following risks:

- Concentration risk: when a disproportionately high amount of wealth is managed, and fees earned, with a select few, key clients. Therefore, the death of one or more of these clients could expose the business to significant costs without an intergenerational wealth strategy in place.

- Mortality risk: when key clients are all in the later stages of their lives. The likelihood of death increases the urgency for these companies to put an intergenerational wealth strategy in place, if one does not already exist.

- Retention risk: when an adviser only has a relationship with the key client, rather than the wider family, exposing the business to significant costs to acquire new customers.

Schroders’ intermediary solutions director Gillian Hepburn, also points to a family office approach as a way to future-proof a business, and that a first step is to assess how the current service proposition meets a younger generation’s needs, such as home ownership.

“For example, does your business advise on protection and mortgages? Reviewing your service proposition can help to identify any gaps that may need filling.”

Charges are another key consideration, Hepburn adds. “Research indicates that younger generations are less willing to pay for ongoing advice, preferring to pay only for the advice they ask for. This means that a fixed fees approach might be required as an option.

“Taking a holistic view on fees is becoming increasingly popular. For example, some advisers choose to give advice on mortgages and protection for the next generation within a family at no cost.”

Family-linked portfolios

Investing is also becoming a priority among the younger generation. Research in April from AML Group and The Nursery found one in 10 investors began investing since the start of the pandemic, of which three-quarters (74 per cent) were under 35.

Hepburn adds that platforms can support a family office approach with discounted administration charges on family-linked portfolios.

Figures from Quilter show that by the first quarter of this year £1 in every eight went into family-linked accounts on its platform, which enables as many family members across four generations to be linked.

Each family member’s charge is based on the total value of all products held on Quilter’s platform by linked family members, and a minimum investment is not applicable.

A family-wide understanding of their collective purpose can act as the foundation for every decision a family will make

Alongside the potential benefits for advisers and clients in casting a wider advice net, Craig Hughes, private client tax partner at accountancy firm Menzies, which offers family office services, warns on the importance of maintaining confidentiality for individual family members.

Hughes says: “While it’s easy to assume that information can be shared, advisers should be conscious of individuals’ personal feelings and demonstrate absolute discretion and privacy.”

Drawing up a family agreement

Hughes also suggests having individual meetings with family members to gain an accurate assessment of their position on combined goals: “These meetings will usually form the basis of a family charter, which all family members will ideally sign up to and support.”

Indeed, research from Prudential with more than 1,000 adults who employed an adviser in the past five years found that squandering, and lack of control over spending by younger generations, were among the reasons holding clients back from adopting wealth transfer strategies.

Priyanka Hindocha, director, family office at Stonehage Fleming, says families that give themselves the best possible chance of sustainable, intergenerational success are those that articulate their purpose, vision and values.

“A family-wide understanding of their collective purpose can then act as the foundation for every decision a family will make. We dedicate a significant amount of time to supporting families through this process of articulating the purpose of their wealth."

She adds: “Understanding individual family members' perspectives on the family and their wealth allows us to identify how best to enable a family to achieve their purpose.”

Working across generations after lockdown

More than a third of advisers have seen an increase in demand for advice on intergenerational wealth transfers as a result of the pandemic, according to a survey from Fidelity.

Indeed, for some families the pandemic may have heightened the circumstances for one generation to support another. Separate research by the Financial Conduct Authority during the pandemic found three in 10 adults experienced a decrease in household income, with young people among those more likely to be affected.

Ian Browne, retirement planning expert at Quilter, predicts this will create a demand for conversations on intergenerational planning.

“The economic pain has mainly been borne by the young who are more likely to have jobs in sectors impacted more by the lockdown.

“Added to this, they have not had the time to build up emergency funds to give them financial resilience. This will create a demand for intergenerational financial planning conversations, in which advisers can help clients to work through their plans to support family members in the future.”

Breaking down barriers to intergenerational planning

Richard Jones, director of Oundle Wealth Management, says the greatest barriers to clients’ children being involved in overall family financial planning are now less problematic, given the take-up of technology during the pandemic.

“Issues such as geographical constraints and not being able to set aside the time have largely been tackled by the use of Teams and Zoom,” says Jones.

“If positioned well this means that clients can involve their children in more discussions if they wish, without it being the sizeable logistical exercise that it was pre-pandemic.”

Chartered financial planner Denese Molyneux, who is also the chair of Step England and Wales – the association for professionals advising families across generations – predicts that multi-generational meetings by video will become a bigger feature after restrictions are fully relaxed.

Molyneux adds: “It will be easier for adult children, who may live some distance from their parents, to engage in the planning process.”

Issues such as geographical constraints and not being able to set aside the time have largely been tackled by the use of Zoom

Robert Morse, partner at The Private Office, remarks that video calls have also made it easier to interact with people who are more loosely connected to clients: “I’ve done lots of meetings where I’m physically with one party and I’ll have another party on a screen. It’s a really neat way of including people.”

The prevalence of technology during the pandemic also means it is not reserved for the young, as Richard Taylor, senior wealth planner at Sanlam, dispels the stereotype of older clients being averse to technology.

“It’s easy to think that it will be the younger, more technologically savvy clients who will be keen to continue this medium of communication,” says Taylor.

“However it is clear that through the necessity of lockdown, our clients both young and old have gained the required level of proficiency to use this technology, and therefore I see no reason to preclude our older clients from these mediums of communication.”

Getting around the table

But Jack Silk, a wealth management consultant at Mattioli Woods, says it is still preferable to have everyone in the same room, face-to-face, for discussions around intergenerational wealth.

“On a video call it’s sometimes a little bit difficult to explain some things. As advisers, we probably use quite a lot of diagrams and things to try and explain where the money goes, and what the structure looks like. And that certainly is much easier face-to-face.”

Quilter’s Browne also says that being able to see clients face-to-face at their home increases the likelihood of meeting other family members.

He adds: “While it's clear that hybrid advice is here to stay, advisers should think carefully about whether at some point it is worth organising a meeting with their client and in-person, as this may help introduce the topic of intergenerational wealth transfer and discuss some options that might be harder to broach in a remote setting.”

Different advisers for different family members

Another option that Campbell Stanners, advisory relationships director at Bankhall and PMS, suggests is multiple advisers within a company serving one family.

Indeed, research from Prudential found a quarter of clients were uncomfortable with one adviser reviewing the whole family’s finances, with a similar proportion (22 per cent) concerned they would tell other family members about their finances.

Stanners adds: “[Multiple advisers within the same advisory firm] can be an effective way of tackling the needs of individual family members who are at different life stages, as opposed to an individual adviser trying to look after the needs of multiple generations within the same family, who may find themselves conflicted.”

Schroders’ intermediary solutions director, Gillian Hepburn, remarks that someone who is likely to inherit wealth may want to work with a younger adviser for their own requirements, separate to the discussions about wealth transfer.

She adds: “The benefit here is that the clients across the generations can work with an adviser where there is more of a ‘personal fit’ and, longer term, the wealth is more likely to remain within the adviser business.”

How to extend your client base

Three in five clients feel positively about having the same adviser as their children, parents or grandchildren, according to findings from Prudential.

The provider’s research also found 43 per cent said they would feel relaxed about having the same adviser as their close relatives, because their family already trusts them. A third said they would feel relieved that multiple generations were using the same adviser.

So, how can advisers tap into this pool of potential clients?

When to meet the family

The appointment of family members as executors and trustees on any wills and trusts creates an opportunity for advisers to meet and engage with these individuals, according to Alex Loydon, private client director at St James’s Place.

Indeed, Richard Taylor, senior wealth planner at Sanlam, likens probate as a potential baptism of fire.

“I’m sure every adviser has sat with an executor, who is pulling their hair out while struggling to locate the 12 savings accounts their late parent split between various banks and building societies,” says Taylor. “Inheriting wealth can be an extremely stressful process.”

Research from Quilter last July found that millennials were the most happy to be involved in discussing family plans to pass on wealth, but also had the least experience in dealing with the finances of a late family member, in comparison to baby boomers and generation X.

Richard Jones, director of Oundle Wealth Management, describes encouraging dialogue across generations as the key to intergenerational planning.

He adds: “Talking openly about money is not always easy, and part of our role is to chair and inform the conversation between generations. When this happens, better results tend to occur for all involved.

“An example of this is when a client wants to make a gift to their adult son or daughter. One of the greatest reluctances here tends to be that they fear the money will be ‘wasted’ or left to accrue a very low rate of income in the bank. A conversation involving the beneficiary, informing and educating them as to how these funds can be best used to achieve their goals leaves all parties happier.”

Sanlam’s Taylor recounts an example of a client who invested a small sum for her son into a bare trust: “He could view the performance on his smartphone, he attended the review meetings and at age 18 the investment became legally his. This was a great way to educate her son on investments.”

Appealing to a younger generation

Taylor’s example of engaging early with the younger generation, supported by technology, can also apply to how a company promotes itself.

Ian Browne, retirement planning expert at Quilter, highlights the role of advertising in appealing to a younger generation, such as having an up-to-date digital footprint.

“No longer do customers rely solely upon company literature, published product reviews and direct word-of-mouth recommendations,” says Browne.

“The younger the generation, the more likely they are to search for you online and be influenced by the experience. Your website design and social media activity could sway decision-making. It can be a great way to connect without having to meet face-to-face.”

Offering customer online portals will be an essential hygiene factor to reach this new audience

The popularity of TikTok has seen advisers and consumers take to the video app to educate and learn about personal finance, with the social media platform announcing last month that it was partnering with Citizens Advice to launch a series on financial literacy.

Browne adds: “Generation Z and millennials expect online information at their fingertips 24/7 – so offering customer online portals will be an essential hygiene factor to reach this new audience.”

As well as reviewing your digital presence, Browne suggests aligning succession planning for clients with that for the business.

“Providing continuity of service to a multi-generational family could involve linking younger advisers within your firm with the younger members of a client’s family. This can help develop empathy between your firm and the younger generations.”

Fees are another factor when it comes to younger clients, as Taylor cites research by Sanlam that found two in five of those aged between 25 and 45, who expected to inherit at least £50,000 from their parents and/or grandparents, had less than £10,000 in savings.

Taylor says: “In recognition of this we have a family fee option where we can arrange basic financial plans for immediate family members of our clients for no additional fee. This is another great way to acquire existing family members of our client as new clients.”

Meeting the other half

But the transfer of wealth between spouses is a “more immediate issue” for many families and advisers, according to Campbell Stanners, advisory relationships director at Bankhall and PMS.

“Advisory firms need to be careful not to overlook what is often the initial stage in the generational transfer of assets, so it’s important for firms to consider how robust their client proposition is in relation to spousal transfer.”

Consider how you currently work with couples and then whether you need to deliver a focused advice proposition for women

Indeed, research from Fidelity International found half of IFAs reported losing female clients once that client’s partner had passed away.

Likewise, Gillian Hepburn, intermediary solutions director at Schroders, raises the issue of women changing advisers when their partner passes away.

“They may simply not see themselves as your clients as they felt shut out of the conversation. So consider how you currently work with couples and then whether you need to deliver a focused advice proposition for women.”